If you ask someone their pay, or the amount they make from their job You don’t know if they’re talking about Gross pay or net pay. Correct? Actually, most times people will only reveal their gross earnings, simply because it’s a bit difficult to describe their net earnings and what their take-home pay is. However, if you’re somewhat confused by the idea of net pay and gross pay, then you’re not alone. If you’re keen to learn more about the salary terminology be sure to keep to read because we’re about to give you the lowdown on exactly what they mean. We will go over the definitions of net and gross pay, and the main distinctions between net and gross pay. Let’s get to the point and then will we?

What is Gross Pay?

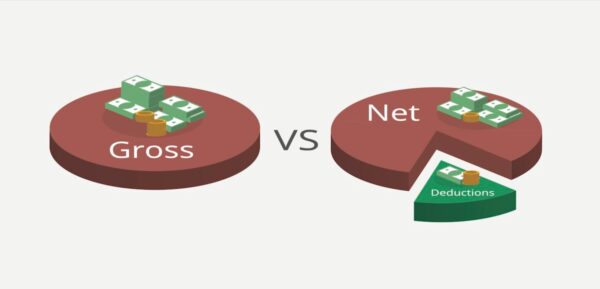

When we talk about “Gross Pay,” we’re really talking about the larger picture. Also Gross pay is the sum of money that you earn before anything is removed. Imagine that you and your boss agree on a contract, maybe Rs.300 per hour. And you are working hard for 40 hours per week. Simple math, right? This is Rs.300 multiplied by 40. This gives you Rs.12,000. This is your gross earnings for the entire week. But wait! Let’s say you worked additional hours or earned some extra cash because you performed well. This is added to Rs.12000. Here’s a quick reminder! If you look at your account at the bank you may find that it’s a bit lower than your gross wage. Be assured that there’s no way that anyone is stealing from you. It’s only that there are some items that are deducted from your pay, which we’ll discuss later. In the meantime, keep in mind that gross pay is your money pie prior to when you can take a slice!

What is Net Pay?

Let’s now discuss something we call “Net Pay”. Consider it this way that when your earnings are rewarded, however you aren’t able to keep it all since some portions are put aside for crucial things. Consider Net Pay as the amount left after you’ve shared those slices. It’s money that you receive to spend on items you require, put aside for the future, or perhaps give yourself a treat. So, what exactly are these “slices” we’re sharing? The slices that are shared go to the government for taxes. A different one could be for insurance, to ensure you’re secure and safe. Also, you could save some money to be able to enjoy your retirement and retire, which is known as retirement.

Differences and The Calculations Process Of Gross And Net Pay

The first question is how do we convert net pay to gross pay? The answer is that gross pay is the main number that we think of when we think of our earnings. If you’re paid per hour think about this scenario that you put in a few hours working. To determine how much you earned prior to any cuts, simply multiply the amount of time you worked by the amount you make per hour. Simple, right? If you are on an agreed-upon salary that you are paid, then your gross wage is the amount that the employer and you decided on. There is no math required in this case!

But Where Does Some of That Money Go?

Now, this is where things can get complicated. From the gross earnings some amounts are taken out prior to when you get a penny. They are referred to as deductions. What is deducted? It’s a good question. Taxes, Health Insurance, Retirement Savings, and other deductions. In the case of your work there could be other deductions such as union fees, or perhaps specific costs related to your job.

After deducting all the expenses The remaining amount is what we refer to as net pay. It’s the money which is put directly to your wallet (or your bank account). This is the money is used to cover your bills purchase groceries, pay for bills or even indulge yourself! But both employers and employees must verify these figures. It’s vital to make sure you’re on the right track! One small mistake today could cause headaches in the future. Achieving that everything is added up properly will ensure everyone is happy and you’ll earn the cash you earned!

The importance of understanding Net Pay vs. Net Pay

Have you ever thought about what the reason to care about net and gross earnings? First of all knowing this information helps to manage your money more effectively. If you know how much cash you’ll get into your pockets (that’s the net amount you earn) it is possible to determine how much you can invest, save or invest. In addition, your gross salary is the number that tax authorities examine. Therefore, if you know this amount, you’ll be ready when it comes time to pay taxes. In this way there won’t be any unexpected surprises at tax time!

Common Misconceptions

Did you look over your check and wondered “Why is my take-home pay less than what I was promised?” Then you’re not the only one! A lot of us believe that the pay we’re given is the amount we’ll receive from our employers. But, surprise! There are pieces and cuts that are removed before it gets to us. It is possible to think that all of these cuts are essential. But, they’re not. Certain things, like taxes, are expected, and will always be removed. However, for other matters such as putting money into retirement accounts or paying for certain insurance expenses is up to you!

Gross Pay Vs Net Pay Overview

| Description | Gross Pay | Net Pay |

|---|---|---|

| Definition | The earnings total prior to deductions and tax. | The amount that an employee earns after deductions and taxes. |

| Calculation | Gross Pay = Hourly Rate x Hours Worked + Bonuses + Overtime – Deductions | Net Pay = Gross Pay – Taxes – Deductions |

| Components | – Hourly or Salary Rate– Bonuses and Overtime

– Additional Income |

– Federal Income Tax– State/Local Income Tax

– Social Security Tax – Medicare Tax – Retirement Contributions – Health Insurance Premiums – Other Deductions |

| Purpose | It is used to calculate the employee’s total earnings as well as their compensation package. | The amount that an employee gets in their pay check. |

| Importance | Aids in budgeting and understanding the earnings potential. | The take-home pay is a significant factor in the financial health of an employee. |

Conclusion

It’s done. You now have a complete understanding of how gross pay is different from net pay, and also what is your take-home pay. Right? In keeping in mind the various aspects we’ve discussed about the difference between net and gross earnings in our post today and you’re better prepared to take on your financial journey over the long haul.