Government Offering Many Benefits on Taking Loans under PM Mudra Yojana and PM SVANidhi Yojana

The global pandemic led to a major economic fall out all over the globe. Many people faced difficulties in terms of finances, due to job losses and pay cuts. To help revive the economy and bring stability to the current pandemic situation the government introduced various schemes like the PM Svanidhi scheme and the PM Mudra yojana. Since the entire country is facing a crisis because of the pandemic, the government made some changes to these schemes by easing the stress on millions of debt holders.

PM Street Vendor’s AtmaNirbhar Nidhi Scheme

The PM SVANidhi government scheme was launched on 1st June 2020 with the aim to offer loans to street vendors. The main objective of the scheme is to provide an economic boost to the street vendors by offering them working capital loans, The loan funds can help vendors to restart their businesses and bring financial stability. With the PM SVANidhi Scheme, vendors can apply for a loan of up to Rs 10,000 for a year with no collateral required. Beneficiaries availing loan under the PM SVANidhi Yojana, can get an interest subsidy at 7%. The interest subsidy on the scheme will be valid till 31st March 2022. Street vendors that belong to peri-urban or rural areas are being included as beneficiaries under the urban livelihoods programme for the first time. The loan under PM SVANidhi Scheme has a loan repayment tenure ranging up to 12 months. Some other perks offered with the scheme are as follows:

- The vendors are encouraged to make digital transactions to avail a monthly cashback of Rs. 100.

- With the scheme a vendor can avail a working capital loan up to Rs. 10,000/-

- Vendors will receive incentives on regular loan repayment

Eligibility Criteria

The following are the eligibility criteria under which the vendors need to qualify for the scheme:

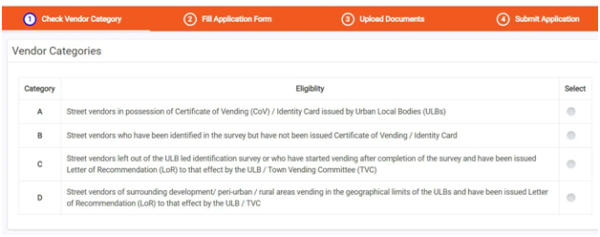

- Vendors who have a Certificate of Vending / ID Card from the Urban Local Bodies (ULBs) are eligible for PM SVANidhi Yojana.

- Vendors who do not have the Vending Certificate / ID Card will be provided with a Provisional Vending Certificate by the Urban Local Bodies (ULBs). The Urban Local Bodies will then provide a permanent Vending Certificate and an ID Card to such vendors.

- Street vendors that did not go through the identification survey or who have started vending post surveys with a Letter of Recommendation (LoR) are eligible to apply.

How to Apply For PM SVANidhi Scheme?

Step 1: To apply you first need tovisit the official website at http://pmsvanidhi.mohua.gov.in/

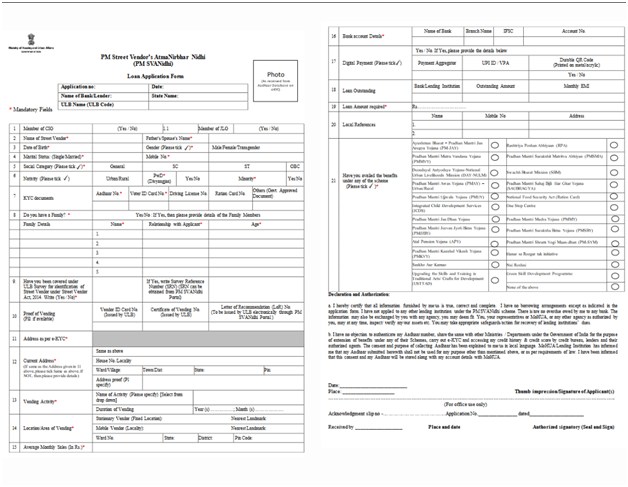

Step 2: You need to download the PM SVANidhi Scheme Loan Application Form.

Step 3: Select the vendor category that you are eligible for under the PM SVANidhi Yojana

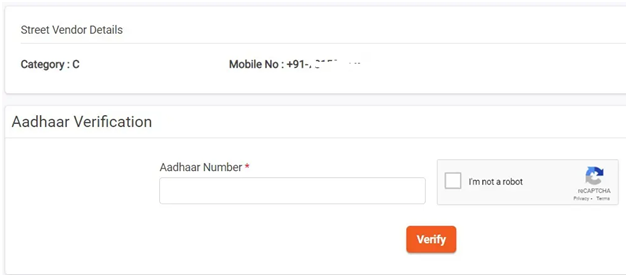

Step 4: Fill the loan application form and ensure you have your Aadhaar number linked to your mobile number.

Step 5: Finally submit the application form after filling in the required details.

PM Mudra Yojana

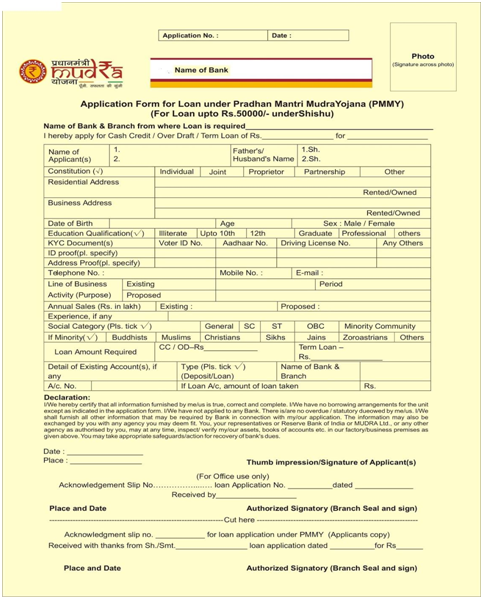

The Pradhan Mantri Mudra Yojana (PMMY) is a government scheme that aims to provide employment in the country and motivate the youth towards self-employment. Micro-Units Development and Refinance Agency (Mudra) is a government established organization that offers funds to MSMEs in India. All public and private sector banks, NBFCs, small banks, rural banks, scheduled banks, and co-operative societies that are registered under the PMMY scheme are eligible. The Mudra loan rate of interest doesn’t go beyond 1% per month and is also dependent upon the base lending rates of the lender. Moreover, there are no processing charges or loan application fees on Mudra loans. The loan repayment tenure of Mudra Yojana ranges between 3 to 5 years.

The Mudra loan is divided into three categories. They are as follows:

- Under the Shishu Loans, you can avail a loan amount of up to Rs. 50,000

- With the Kishor Loans, you can avail the loan amount of up to Rs. 5,00,000

- With the Tarun loan, you can avail a loan amount of up to Rs. 10,00,000

Eligibility of Mudra Loans under PMMY

To be eligible for the PMMY scheme the applicant must have Indian citizenship.

- The loan amount required should not be Rs. 10 lakhs or less.

- The enterprises generating income from farming activities are not eligible for MUDRA loan.

- SMEs in the rural and urban areas are eligible for Pradhan Mantri Mudra Yojana.

Procedure for Mudra loan Online Application:

Step 1: Visit the official website of the financial institution with which you wish to avail the Mudra loan and download the form (Shishu, Kishore, Tarun)

Step 2: Download the form of the loan you require and enter all your personal and business details like your Name, Date of Birth, Residential/ Business Address and educational qualifications, etc. in the Mudra loan application form

Step 3: Submit the application form along with the required documents with the bank or lending institution you are applying with.

Step 4: The Mudra loan online application form and attached documents are sent for verification. Once approved the loan amount is disbursed in the form of MUDRA Card where you can withdraw money from the card whenever required.